- June 3, 2023

- Posted by: mararting

- Category: Broker News

Layaway Depot Pty Ltd, a company that enables customers to purchase electronic goods through installment payments, has been fined $375,000 for engaging in unlicensed credit activity and providing high-cost credit.

The Federal Court discovered that Layaway imposed excessive interest rates on 70 loans acquired by consumers to buy electronic items like mobile phones, televisions, and speakers.

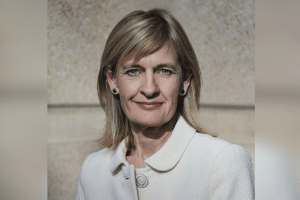

The court found several instances where customers paid significantly more than the market price for their purchases. For instance, one consumer paid a total of $780 in installments for a Bluetooth speaker that was originally priced at $200, while another paid $1,200 for a mobile phone that had a retail price of just $249. ASIC deputy chair Sarah Court criticized the exorbitant prices, particularly when many consumers relied solely on Centrelink benefits as their income. She emphasized ASIC’s commitment to addressing consumer harm in credit provision, particularly for financially vulnerable individuals.

The Federal Court ruled that Layaway engaged in unlicensed credit activities and charged consumers an annual cost rate exceeding 48% for 70 payment agreements. The court issued an injunction permanently preventing Layaway from participating in credit activities and entering into credit contracts with an annual cost rate surpassing 48%.

Court highlighted that ASIC pursued the case due to its belief that Layaway intentionally structured its contracts to circumvent consumer protections established under the Credit Act. These protections, including the maximum permissible annual cost rate, aim to ensure fair credit provision and prevent exploitation of individuals.

ASIC pointed out that Section 9 of the National Credit Code considers goods leases involving a purchase obligation as sales of goods by installments, treating them as credit contracts. The Code prohibits lenders from entering into credit contracts with an annual cost rate exceeding 48%, taking into account fees, charges, and repayment timing.

ASIC further explained that as of June 12, 2023, new consumer protections would be in place for individuals who enter into small amount credit contracts (SACCs) and consumer leases due to amendments introduced by the Financial Sector Reform Act 2022.

These protections include limits on consumer lease costs, restrictions on the percentage of income used for SACC or consumer lease repayments, and anti-avoidance provisions aimed at discouraging practices that evade SACC and consumer lease regulations.